Yuchai received a reduction of over 21 million yuan in corporate income tax

Recently, the manager of the Finance Department of Yuchai Group told the author: “This tax concession is very important and it is a 'timely rain' that effectively eases the capital turnover of the company. We are very grateful to the national tax department for their strong support.†In April of this year, the Yulin City Taxation Service Team of the National Taxation Bureau discovered during the research of Yuchai Group that after the country implemented the reform of the corporate income tax system in 2008, the preferential tax policies enjoyed by the Yuchai Machinery Company and some foreign-invested enterprises changed. Chai Ji and some foreign-invested companies have not previously applied for preferential policies for the development of the western region. According to the current tax policy, this part of the company can collect corporate income tax at a reduced rate of 15% from 2008 to 2010. The Yuchai Machinery Corporation and other 13 outdoor business investment company divisions still choose 18% of the income tax rate when the 2008 corporate income tax is settled and settled. After learning of the situation, the Yulin City National Taxation Bureau provided the company with “through-train service†and submitted the materials to the State Administration of Taxation in time for Yuchai Group to obtain a tax rebate of more than 21 million yuan in corporate income tax. It is understood that the Yulin Municipal State Taxation Bureau has set up the “Service Enterprise Yearâ€, “Project Service Yearâ€, and “Party Service Year†activities this year to form a corporate rescue service team, a production promotion service team, and a through train service team for the enterprise. Seek ideas, solve problems, and work with companies to overcome difficulties. At the same time, standardize the administrative examination and approval procedures, optimize the work flow, implement electronic examination and approval, implement online taxation, and open up “green channels†for tax incentives to facilitate the re-employment of laid-off and returning rural migrant workers, and provide relief for enterprises. Up to now, the Bureau has applied for corporate income tax relief for 13 companies totaling 76.85 million yuan in tax, to ease the pressure on corporate capital turnover, and promote the development of SMEs in Yulin City.

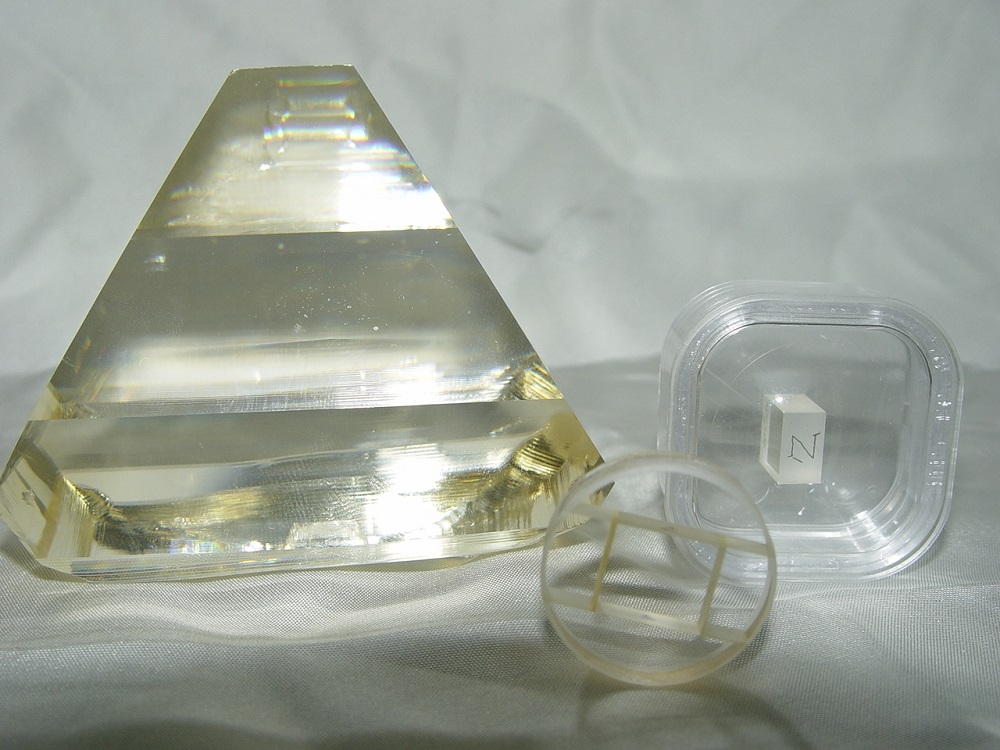

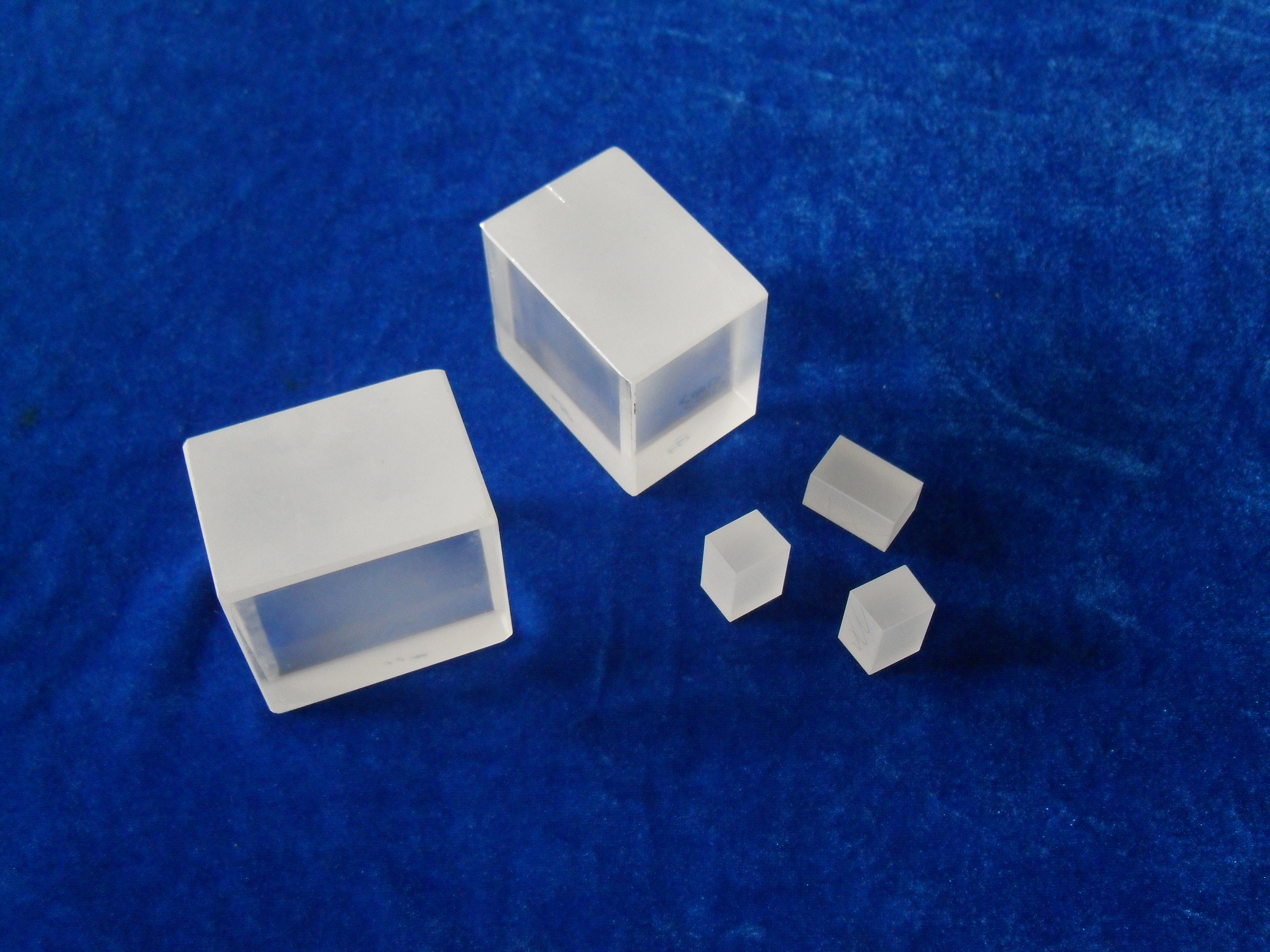

Coupletech Co., Ltd could manufacture and supply a variety of nolinear Optical Crystal ( NLO crysal ), which is Lithium Triborate (LBO) crystal, Potassium Titanyl Phosphatecrystal ( KTP ) crystal, KTA crystal, Beta Barium Borate ( BBO) crystal, BIBO crystal, Lithium niobate ( LiNbO3, LN ) crystal, Potassium Dihydrogen Phosphate & Potassium Dideuterium Phosphate (DKDP (KD*P) and KDP ) crystal, periodically poled crystal ( MgO: PPLN, PPLN ) crystal and infrared nonlinear optical crystals ( AgGaS2, ZnGeP2 ) crystal with top quality, unbeatable prices, prompt delivery and the best pre- and post- sales technical support and services, for not only science users but commercial customers and industrial manufacturers all over the world.

Coupletech's NLO crystal is widely used for frequency doubling ( SHG ), third-harmonic generation ( THG ), sum frequency (SFG), optical difference frequency ( DFG ), optical parametric oscillator ( OPO ), and so on.

Nonlinear Optical Crystals,KTP Crystals,BBO Crystals,LBO Crystals,BIBO Crystals,KTA Crystals,LN Crystals,PPLN Crystals Coupletech Co., Ltd. , https://www.coupletech.com