Development trend of power battery and analysis of its supporting pattern

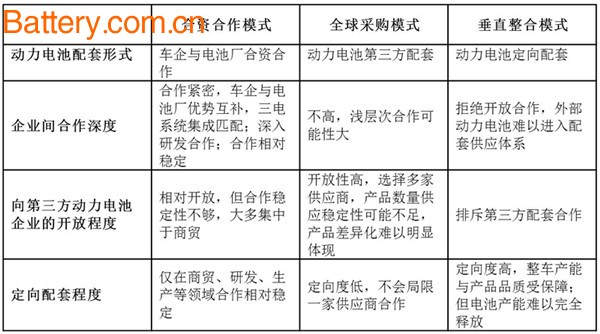

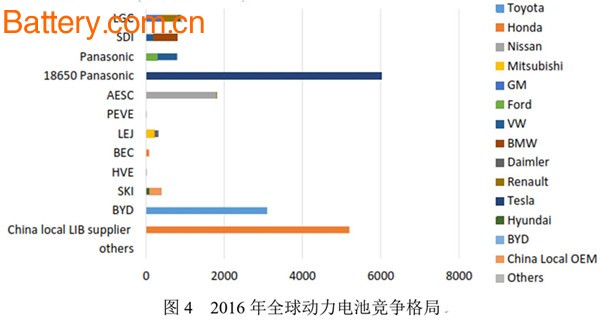

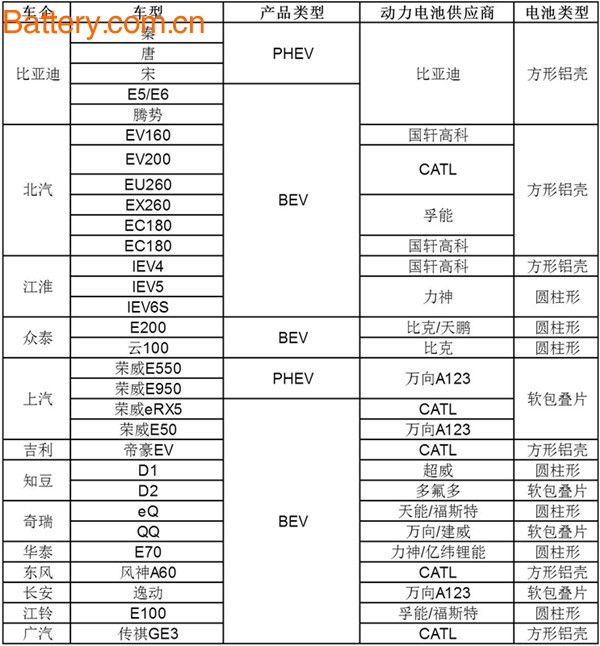

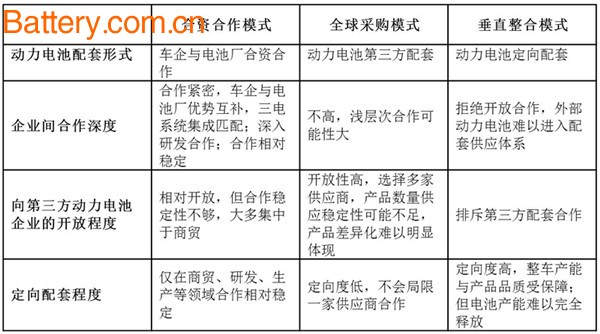

Recently, the Ministry of Commerce website published the "Shanghai Automobile Group Co., Ltd. and Ningde Times New Energy Technology Co., Ltd. New Joint Venture Enterprise Case". According to the public announcement, SAIC and Ningde Times jointly established two companies: Times Shangqi Power Battery Co., Ltd. And SAIC Era Power Battery System Co., Ltd., which is mainly engaged in the development, production, sales and after-sales service of lithium-ion batteries and lithium polymer batteries, focusing on the deep research in the field of battery electrochemistry; Battery Systems Co., Ltd. is mainly engaged in the development, production and sales of power battery modules and systems, focusing on research in the field of automotive and dynamics. The cooperation between SAIC and Ningde era has triggered the industry's attention to the competition of new energy automobile industry chain and power battery supply. After the release of China's Medium- and Long-Term Development Plan for the Automotive Industry, local governments have accelerated the industrialization of new energy vehicles. In conjunction with the Interim Measures for the Parallel Management of Enterprise Average Fuel Consumption and New Energy Vehicle Points by the Ministry of Industry and Information Technology (Draft for Comment), the proportion of new energy vehicles in 2018, 2019 and 2020 should reach 8%, 10% and 12% respectively. According to this conservative estimate, the domestic new energy vehicle market will release about 1 million units of production capacity next year, which will also drive the simultaneous release of power battery companies' production capacity. The joint venture between the OEM and the power battery company has created a new format for cross-border integration and development for the large-scale promotion and application of new energy vehicles and the common Nugget Blue Ocean. It also blew the horn of the industry chain competition. With regard to this important trend, we put forward some views on the development of the new energy automobile industry and the supporting laws and patterns of the power battery. First, the power battery joint venture cooperation is the inevitable development of the industry As far as the traditional car is concerned, “the engine is the whole vehicleâ€, because the power system is the core lifeline of the car; for the new energy car, the power battery is the inevitable choice for the differentiated competition of the whole vehicle enterprise, “the power battery†It means winning the preconditions for sustainable development and avoiding homogenization competition. In the era of traditional fuel vehicles, domestic and foreign passenger car and commercial vehicle companies have their own engines, and they have mastered the core competitiveness and profit of the brand by mastering the production process of engine core components and key core components. Under the wave of new energy vehicle development, the core powertrain is no longer an engine or gearbox, but a large electric system consisting of batteries, motors and electronic controls. The technology is still rapidly iterating, with the highest cost and profit. The battery is the most important thing. Therefore, the OEM is bound to master the high-quality battery core package through self-built or joint-venture construction. Considering the choice of technical route and the attribute characteristics of the cell electrochemical field, it is expected that the heat of joint ventures with first-line battery companies to establish factories or establish strategic partnerships will continue to increase. Because the cost of power batteries is the highest and the profits are relatively high, the whole vehicle and power battery companies must continue to develop with the pursuit of competitiveness and profit. We may wish to compare and analyze the cost ratio of the total vehicle and engine of the passenger car/commercial vehicle, and the cost ratio of the new energy vehicle and the power battery. 1. Fuel passenger car parts cost structure In combination with a car company has announced the proportion of a car parts, the cost of traditional fuel passenger car engine accounts for about 15%, the highest ratio. In fact, among the domestic mainstream passenger car companies, regardless of state-owned, joint venture or private car companies, their own vehicle companies, engine companies, and even transmission enterprises, this means that the engine is the core that the vehicle manufacturers must consider to control or possess. Parts. 2, fuel commercial vehicle parts cost structure Traditional fuel commercial vehicle engine costs account for about 23% of the total cost. And the scale of engine capacity determines the scale effect of the whole vehicle to a large extent, with Beiqi Futian and Shangyihong as typical enterprises. Since entering the heavy truck industry, Beiqi Foton has purchased engine enterprises such as Weichai by integrating social resources. Its vehicle sales volume has always been in the second echelon, ranking behind heavy trucks, FAW, Dongfeng and Shaanxi Auto. With the further expansion of the company's scale, Beiqi Foton has increased cooperation with Daimler and Cummins. Since 2015, the scale of production and sales of the whole vehicle has become the first echelon of the heavy truck industry. Since the 20th century, the scale of production and sales of Shangyiyi's production and sales has remained at a level of 10,000 to 30,000 for a long time, which is largely affected by the bottleneck of supporting purchases of engines. It can be seen that the commercial vehicle engine is also crucial to the vehicle enterprise. 3. Cost structure of new energy auto parts The biggest cost of electric vehicles is in the battery, motor and electronic control "three major power" systems, of which the power battery cost bears the brunt. Domestic and foreign new energy auto industry giants Tesla and BYD have strategically expanded the power battery factory to ensure the corresponding production capacity. In fact, the production and sales scale of these two electric vehicle companies ranks among the top in the world, while the installation of BYD power batteries The quantity is the leader of the country and the world. Those who have power batteries have also got a new energy vehicle market. At present, the domestic power battery technology continues to improve, the battery quality interval gradually increases, the cost difference under the scale advantage also increases, the industry concentration gradually increases, and the oligarchic competition appears. According to market statistics, in 2015, the CR5 of the power battery industry was 59%, and in 2016 it was increased to 68%. The battery companies accelerated their concentration. The trend of the joint main engine factory is irreversible. From the perspective of the joint venture cooperation, BAIC and South Korea SK and Guoxuan Hi-Tech Joint venture, A123 and SAIC, Guangzhou-Guangzhou joint venture cooperation, mainstream battery companies and well-known vehicle companies closer cooperation, and this joint venture between SAIC and Ningde era will further catalyze the strong alliance of the industry. Second, the characteristics of the power battery supporting pattern 1. International passenger car vehicle power battery supporting pattern At present, the supporting suppliers of global power battery support are mainly concentrated in Japan, South Korea and China. In 2016, the competition pattern of lithium-power battery is: Japanese and Korean new energy vehicles supporting Japanese and Korean host factories to control or joint venture power battery enterprise products; The US-based new energy vehicles are equipped with Japanese and Korean power battery companies, among which Tesla is preparing to build its own super-power battery factory; Europe-based new energy vehicles are supporting leading power battery companies in Japan, Korea and China. At least two or three power battery suppliers have been selected for pure electric and plug-in hybrid vehicles at these OEMs. Table 1 Supporting the power battery of typical foreign models From the competitive landscape of international lithium battery supporting OEMs, Tesla, BYD and Nissan's models are leading sales, driving suppliers to inject Panasonic, BYD batteries and AESC batteries, while other power battery companies are leading the way. The matching rate is relatively low. The international power battery supporting pattern presents a clear brand spillover effect. With the improvement of the quality of China's power battery products and the growth of the industry scale, it is expected that the competition and supporting pattern of the power battery industry will show new changes in the future. 2. Domestic passenger car and vehicle power battery supporting pattern From the situation in China, there are a large number of domestic new energy vehicle power battery companies, and the requirements for customizing the power battery of passenger cars are constantly improving. At present, the main suppliers are CATL, BYD, Wanxiang A123, Fu Neng, Guoxuan Hi-Tech, Lishen, In addition to cylindrical batteries, square aluminum battery has become an increasingly popular choice for most battery companies. From Table 2, it can be found that the domestic new energy passenger car power battery mainly comes from CATL, BYD, and Wanxiang A123. Among them, BYD models support BYD power batteries, and CATL has close cooperation with BAIC and SAIC. The growth of the sales volume of enterprise products is matched, and the supporting quantity of power batteries is also rising. Changan, Chery and other OEMs have selected different power battery companies based on comprehensive factors such as product quality, supporting radius, product differentiation and product cost. Smaller, the supporting stability is relatively insufficient. Table 2 Domestic typical new energy passenger car power battery supporting situation 3. Domestic commercial vehicle and vehicle enterprise power battery supporting pattern In terms of power battery support for new energy buses, combined with the scale sales of domestic Top10 electric bus companies in 2016, the first echelon of commercial vehicle battery suppliers is BYD and CATL, and the second echelon is Watmar, Guoxuan and Lishen. The third echelon is BAK, Wanxiang, AVIC Lithium , Pride, and Union. Judging from the situation of the OEM, Yutong and BYD, which are leading domestic production and sales scales, basically choose power battery companies, while Zhongtong and Nanjing Jinlong mostly choose 2 to 3 battery suppliers. Table 3 2016 Top10 electric bus enterprise power battery supporting situation 4. Industry characteristics of domestic power battery supporting As for the domestic new energy vehicle power battery supporting pattern, the matching situation between the main engine factory and the power battery factory has the following characteristics: In addition to BYD, passenger car companies do not have absolute control of power battery companies, and Top10 companies in the new energy vehicle industry have selected a number of supporting suppliers, and the depth of cooperation needs to be strengthened; The power batteries for new energy passenger cars and passenger cars have both general-purpose accessory products and power battery products for passenger cars; There are a large number of power battery suppliers, and at the same time, they also provide support to a number of OEMs. The scale of the single power battery enterprises is small; The echelonization competition pattern of power battery enterprises has basically taken shape. BYD and CATL are in the first echelon. The strategic adjustment of their enterprise development will affect the development of the echelon battery companies and joint venture cooperation to a certain extent; The deep cooperation between the main engine factory and the power battery company is the trend of the times, and the reorganization and merger between the power batteries will also be imperative. Third, thinking and suggestion on the supporting mode of power battery In combination with the “double points†policy, in 2020, the proportion of new energy vehicles in vehicle sales vehicles is 12%, and the average annual growth rate of traditional fuel vehicles is 3-4%. In 2020, the sales of new energy passenger vehicles need to reach Nearly 3 million vehicles, the growth demand of the new energy vehicle market will drive the incremental development of the power battery industry; in addition, the National Action Plan for Promoting the Development of Automotive Power Battery Industry will also promote the expansion of power battery companies, then the power battery companies must Consider joint ventures with OEMs. Combined with the current domestic and international power battery supporting pattern and supporting relationship, the future power battery industry will coexist in multiple modes, as shown in Table 4. Table 4 Typical supporting situation of domestic new energy vehicle OEMs and power batteries In light of China's national conditions, under the premise of meeting the conditions of national policies and regulations and the relationship of zero-interest interests, the supporting model scenario of the power battery industry can make the following predictions: 1. Joint venture and cooperation (including holding and shareholding) model At present, the global power battery industry has a successful case of this model. The joint venture or cooperation will be the inevitable development of the integration of new energy auto companies and power batteries. From the perspective of R&D, the OEM's R&D models need a verification cycle of 2 years or more. Most of the OEMs integrate the matching power system, and consider cooperating with suppliers to ensure the stability of battery product quality and supply. Battery factory joint venture cooperation is a must; from the market point of view, the OEM procurement package is relatively stable, and the joint venture cooperation model has a broad market base, both for the OEM and power battery companies are profitable. 2. Global procurement model Globalization and large-scale procurement of automobile OEMs can greatly reduce the procurement cost of power plants in the main engine. LG, SAMSUNG, etc. are typical of power companies that are globally procured as automakers. However, such enterprises must be technologically advanced and powerful enterprises, and they may be in an invincible position. At present, there are not many power battery companies in China. 3, vertical integration supporting mode In the cycle of the public, BYD's production vehicles adopt the vertical integration mode. The initial effect is quite obvious. The company has carried out the original product technology and market accumulation, which laid the foundation for the further development of the company. At the same time, however, battery companies are also facing the temptation of a larger market share. It is not excluded that new enterprises in this mode will appear in China. 4. Industry alliance of division of labor The OEMs and power battery companies and other parts companies and operating companies will promote the complementary resources of suppliers in all sectors of the new energy automobile industry chain by creating industry alliances to promote the synergy effect of the division of labor in the entire industry chain. Capacity and synergy. The enterprises in this model rely more on the strength of the regional industrial chain to achieve matching, so there is a certain degree of local protectionism "suspect", but at the current stage is a better supporting mode. 5, other For the new construction of enterprise power batteries, it is expected that domestic OEMs will not be willing to invest their main energy in the capital, manpower and technology-intensive battery industries. Therefore, it is unlikely to invest in new battery plants, but more will take mergers and acquisitions. Reorganized way to obtain power battery supply. In general, from the point of view of the OEM or the power battery company, it is necessary to maintain the attitude of openness and cooperation. The ultimate solution for new energy vehicles and core components lies in international supply and support. The competition for power batteries is not only The competition of batteries alone, the competition of new energy vehicles is not the competition of individual auto companies, at least to the level of competition in the industry chain. In addition, in 2020, China's new energy vehicle subsidy policy will be greatly reduced or canceled. At that time, independent brands, joint venture brands and foreign brands will return to the same starting point. Considering the competitiveness of vehicle manufacturers, product iteration, core component constraints, cost control, profit acquisition and other factors, taking into account the supporting market and cycle of power battery companies, product supply and quality, scale and profit, etc. A joint venture with a power battery is not a suitable choice. Only the new energy automobile industry as a whole is thriving, and the power battery industry can truly exert its own value. Based on the supporting development of vehicle manufacturers and power batteries, Zhidian Automobile has the following recommendations: 1. Based on the competition of the new energy automobile industry chain, the industrial ecological main body will jointly consolidate the industrial foundation and actively promote the joint venture and cooperation between the new energy automobile main engine factory and the power battery enterprise. With the help of the “One Belt, One Road†initiative, the main engine factory is ready to compete from domestic competition to international competition. The power battery is based on domestic support and is moving towards international support, and gradually completes the global layout. 2. Strengthen the in-depth cooperation between new energy vehicles and power batteries, and strengthen professional division of labor and collaboration. It is suggested that the whole vehicle should focus on the integration and matching of new energy vehicle power systems; the power battery enterprises should focus on the technical routes, professional models of subdivision models, core components, key materials and other technologies to form differentiated competition and occupy corresponding segments. The technical commanding heights of the field. 3. Introduce automobile insurance, auto finance and third-party certification institutions to build and improve the battery recycling and reuse mechanism for the joint development of vehicle and power battery companies. 3/4/6 Axis Automatic Laser Welding Machine 3/4/6 Axis Automatic Laser Welding Machine,Butt Laser Welding Machine,High Efficiency Laser Welding Machine,Automatic Metal Welding Machine Herolaser , https://www.hclaserwelding.com